- 8am – 6pm (Monday-Friday)

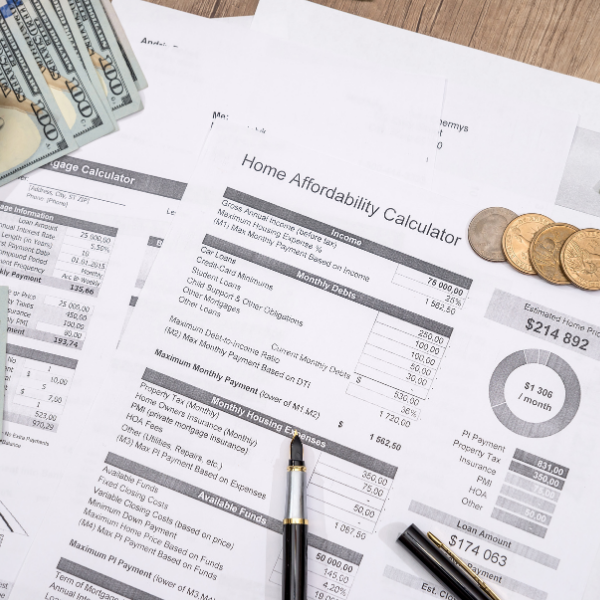

Bank statement loans are designed for self-employed buyers whose tax returns do not reflect their true income. Instead of relying on adjusted gross income, lenders review deposits made into personal or business bank accounts. This provides a more accurate picture of how entrepreneurs actually earn.

Scott has helped many business owners, contractors, and freelancers qualify through bank statement programs that match their real financial flow.

A bank statement mortgage reviews 12 to 24 months of deposits. These deposits are used to calculate qualifying income based on the lender’s guidelines. This approach often allows self-employed borrowers to qualify for higher loan amounts than they would using tax returns alone.

Key factors lenders evaluate include:

This method provides flexibility without sacrificing underwriting reliability.

This loan option is often the best fit for:

If your income is stable but your tax returns do not tell the full story, a bank statement loan may be the most accurate way to qualify.

The documentation process is straightforward and typically includes:

Most programs do not require tax returns.

Lenders calculate qualifying income by averaging deposits based on the program:

These loans review deposits into personal or business accounts. Instead of relying on tax returns, lenders use 12 to 24 months of bank statements to calculate qualifying income.

Deposits are reviewed more directly since business expenses have already been paid before funds reach the personal account.

This provides a fair and realistic view of what you actually earn.

Bank statement loans offer several advantages:

For many buyers, this program offers access to financing they cannot get through conventional guidelines.

Scott walks each client through the steps needed for a smooth experience:

Well-organized statements help the process move quickly.

Down payment requirements vary by lender, but many programs allow standard down payment options.

Yes. Lenders can review either type. Some borrowers use a combination depending on the strength of each account.

Rates can be slightly higher than conventional loans, but the added flexibility often makes these programs more accessible for self-employed borrowers.

No. Strong credit helps, but many lenders offer flexible credit guidelines for bank statement borrowers.

If your income fluctuates or tax write-offs reduce your qualifying numbers, a bank statement mortgage may provide the flexibility you need. Scott will review your statements, explain your loan options, and help you determine how much you can qualify for.

Start your bank statement loan review today.